China Mike’s 100% verified, no B.S. China facts (interesting & fun statistics):

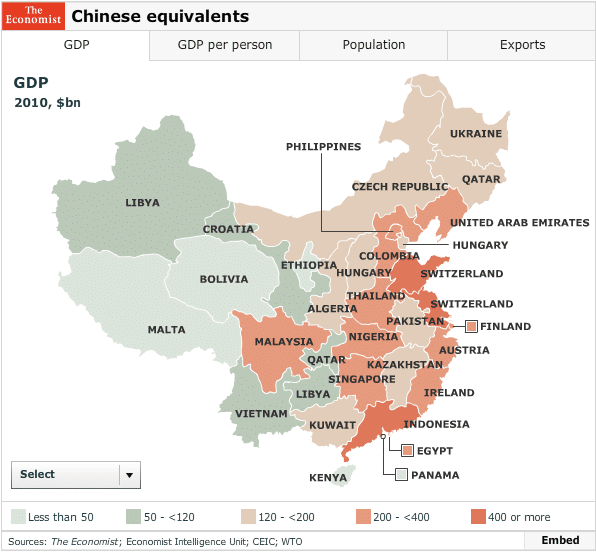

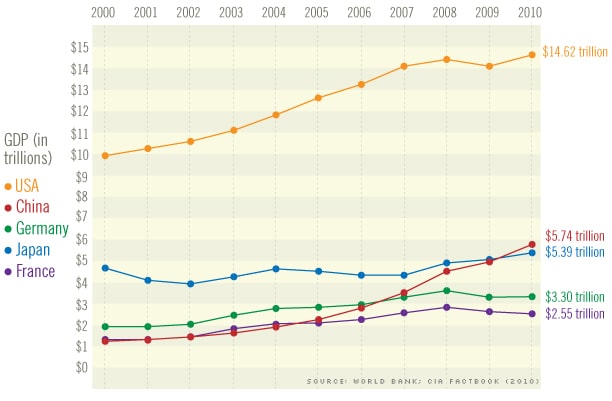

CHINA’S GDP 2010-2011:

GDP (purchasing power parity): US$9.872 trillion (2010 est.)

GDP global rank: #3 (behind the European Union and the U.S.)

GDP, real growth rate: 10.3% (2010 est.)

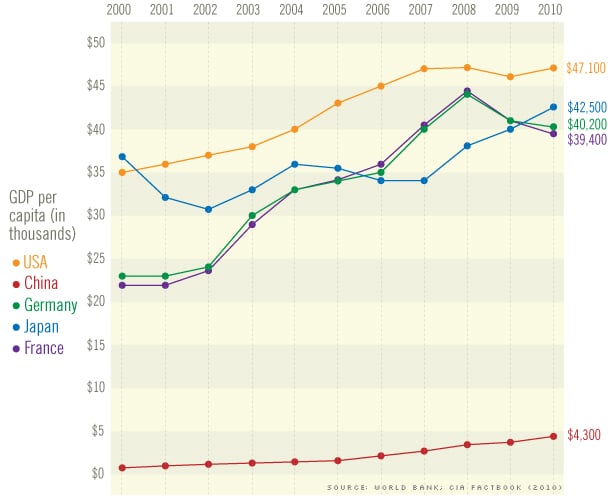

GDP, per capita: US$7,400 (2010 est.)

Labor force: 819.5 million (2010 est.), #1 global ranking

Population below the poverty line: 2.8%

[ Source: CIA World Fact Book, accessed 2011 ]

CHINA’S GDP & ECONOMIC GROWTH

China is the world’s fastest-growing major economy, with an average growth rate of 10% for the past three decades years.

[ Wikipedia ]

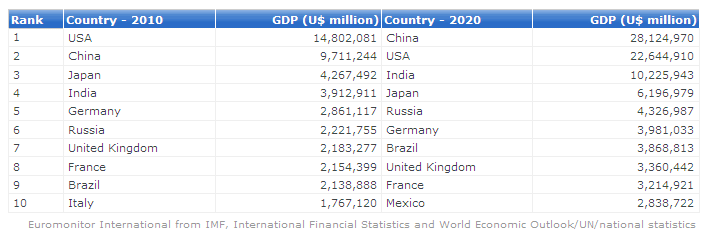

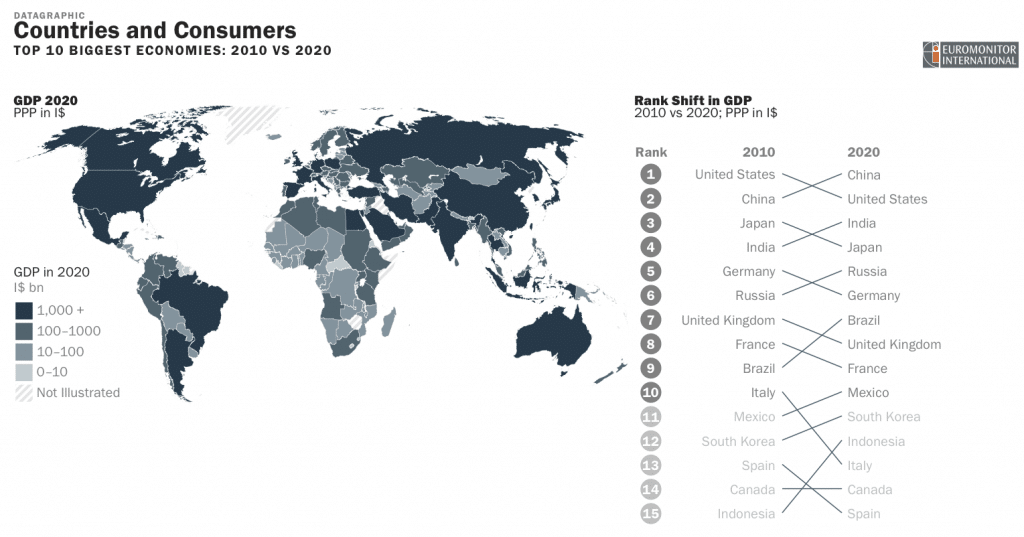

In 2000, China’s accounted for only 7.1% of the world’s total GDP (in PPP terms). In 2010, that figure increased to 13.3%. By 2020, it is expected to reach 20.7%.

[ Euromonitor International “Top 10 largest economies in 2020” July 7, 2010 ]

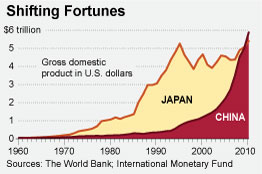

In 2000, China topped Italy to become the world’s sixth-biggest economy. In 2005, China overtook France to become the fifth-largest. In 2006, it moved up again by knocking off the U.K. In 2007, China became the third-largest economy by topping Germany.

[CIA World Fact Book; Fortune “China is richer, but most Chinese are still poor” Feb. 17, 2011 ]

However, China’s per capita GDP still only ranks #127 (2010), just under that of Albania and Turkmenstan.

[CIA World Fact Book, accessed 2011 ]

Q: How many million Chinese live on less than $1/day? Find out in China Facts: RICH, POOR & INEQUALITY.

China is the world’s second largest economy, after overtaking Japan in 2010.

[The Economist online Aug.16, 2010; CNBC Aug. 2010, The Guardian UK Feb. 2011]

China could overtake the U.S. as the world’s biggest economy by 2030, according to economic experts.

[ New York Times, “China Passes Japan as Second-Largest Economy” August 15, 2010]

China could overtake the U.S. as the largest economy as early as 2027, according to Goldman Sachs Group Inc. chief economist Jim O’Neill.

China’s economy could overtake the U.S. economy by 2019, “given reasonable assumptions”, according to The Economist in 2011. The posting says that “Absent a total disaster in China, the transition will take place, and that right soon. Why? Well, China remains far behind the developed world in per capita terms, and because there is plenty of catch-up left to accomplish, there’s plenty of room for rapid growth. And China’s population is enormous. It has over four times as many people as America, and so its output per capita only needs to be about a fourth of America’s to match it in total size.”

[ The Economist online, “How to gracefully step aside” Jan. 11, 2011]

“China will overtake the USA to become the largest world economy in 2017,” predicts the Euromonitor International. The global market research group writes: “By 2020 there will be a major shift in the global balance of economic power compared to 2010….Emerging economies will rise in importance and China will have overtaken the USA to lead the list of the world’s top ten largest economies by GDP measured in PPP terms.”

[ Euromonitor International “Top 10 largest economies in 2020” July 7, 2010 ]

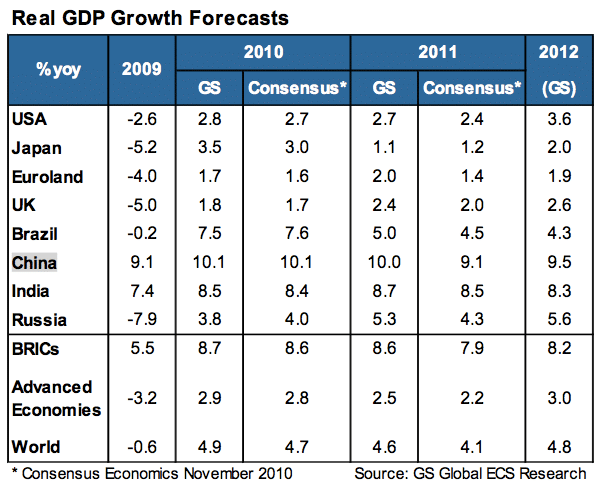

China’s GDP growth for 2011 is forecasted to be 9.1 to 10.0%, according to Goldman Sach’s Global Economics, Commodities and Strategy (ECS) Research group.

[ Goldman Sachs “Global Economic Outlook 2011” Dec. 2010 ]

China’s GDP growth for 2012 is forecasted to be 9.5%.

[ Goldman Sachs “Global Economic Outlook 2011” Dec. 2010 ]

Between 2010-2020, China’s average annual real GDP growth rate is expected to be 9.5%.

[ Euromonitor International “Top 10 largest economies in 2020” July 7, 2010 ]

In a 2011 Gallup poll, 52% of Americans named China as the world’s leading economic power today…compared to only 32% of Americans naming their own country.

[Gallup’s annual World Affairs survey, “China Surges in Americans’ Views of Top World Economy” Feb. 2011 ]

CHINA’S COMPETITIVENESS & INNOVATION

China ranked #27 in the 2010-2011 Global Competitiveness Report, published by the World Economic Forum. The #1-5 rankings: Switzerland, Sweden, Singapore, USA, and Germany.

[ World Economic Forum; Wikipedia “Global Competitiveness Report” ]

China jumped up to #54 from #59 in the 2009 Global Innovation Index (Economist Intelligence Unit)—a gain that was expected to take five years instead of two. China’s was “the biggest gainer among all economies, developed and emerging”, out of 82 countries.

[ The Economist “Global Innovation Index: Exercising patents” April 24, 2009 ]

China ranked #21 (out of 40 countries) in its own global innovation ranking, according to the Chinese Academy of Science and Technology for Development (CASTED). CASTED executive vice president Wang Yuan remarked: “Although China has a scale advantage in innovation resource and knowledge creation, it still has a big gap in innovation efficiency, intensity and quality compared to developed countries.”

[Xinhuanet “China ranks 21st on its own global innovation list” Feb. 25, 2011 ]

China will surpass the U.S. in patent filings in 2011, according to an Oct. 2010 report by Thomson Reuters. On Jan. 2011, Bob Stembridge, an intellectual-property analyst at Thomson Reuters, said: “It’s happening even faster than we expected”.

[ The New York Times “When Innovation, Too, Is Made in China” Jan. 1, 2011 ]

The Chinese government has set a target of two million patent filings by 2015, a figure that the director of the U.S. Patent and Trademark Office called “mind-blowing numbers.” In contrast, the U.S. filed about 480,000 patents in 2010. However, according to innovation consultant John Kao, China’s strategy “is a brute-force approach at this stage, emphasizing the quantity of innovation assets more than the quality.”

[ The New York Times “When Innovation, Too, Is Made in China” Jan. 1, 2011 ]

No Chinese citizen has won a scientific Nobel Prize. In addition to “a government that throws money at research in pursuit of the prize, rather than reforming a rigid state-run education system that is heavy on rote memorization, discourages creativity and drives some leading minds to leave,” China’s “biggest hurdle is a science and academic structure that is hampered by plagiarism, bureaucracy and a traditional deference to authority.”

[MSNBC “China faces hurdles amid quest for a Nobel” Oct 6, 2010 ]

Facts about China’s economy: HISTORICAL

In the 18th century, China’s economy was the largest in the world and accounted for 25% of global output. But by the first half of 20th century, China was known as the “the poor man of Asia”. In 1949—when China had a quarter of world’s population—its economy only produced only 5% of global output.

[ “China: Asia in Focus”, R. LaFleur 2010]

In 1850, China supported almost half a billion people with agricultural technology that was largely developed 1,000 years earlier.

[ “China: Asia in Focus”, R. LaFleur 2010]

In 1949, 89% of China’s population lived in the countryside, with agriculture accounting for about 60% of total economic output.

[ “China: Asia in Focus”, R. LaFleur 2010]

Since 1978, China’s economy has doubled in size every eight years.

[“The Party” R. McGregor 2010, page 28]

Between 1978 and 2005, China’s economic output—as measured by real gross domestic product GDP—grew 9.6% per year.

[“China: Asia in Focus”, R. LaFleur 2010, official Chinese state statistics]

Between 2000 and 2007, China’s international trade exploded—with exports increasing almost 490% and imports growing 425%.

[ “China: Asia in Focus”, R. LaFleur 2010]

The backbone of China’s economy, agriculture and industry together employ more than 70% of the China’s labor force and account for over 60% of the country’s GDP.

[ Rediff Business online, November 2010 ]

China Facts: FX RESERVES & CURRENCY:

Big Mac Index & PPP: China’s weak currency—which is good for Chinese exports—also makes the yuan (RMB) one of the most undervalued currencies in the so-called “Big Mac index”, a measure of purchasing-power parity. While a Big Mac averages US$3.71 in the U.S…..you can buy one in China for only 14.5 yuan (US$2.18) in Beijing and Shenzhen on average.

[The Economist online, “Bun Fight” October 15, 2010 ]

China is poised to make its money a global currency, which “could strengthen China’s influence in overseas financial markets and begin to erode the dollar’s dominance.” According to Nobel laureate economist Robert A. Mundell: “The RMB is likely to become a reserve currency in the future, even if the government of China does nothing about it.”

[ New York Times “In China, Tentative Steps Toward Global Currency” Feb. 10, 2011 ]

China’s has over US$1 trillion in foreign exchange reserves (exceeding Japan’s), and continue to grow around $200 billion each year.

[ The World Bank ]

China’s foreign-exchange reserves hit record highs on Q4 2010 to reach US$ 2.85 trillion. The $199 billion gain was the largest quarterly increase since Bloomberg data began in 1996.

[ Bloomberg “China’s Currency Reserves Rise to Record, Domestic Lending Exceeds Target” Jan. 11, 2011 ]

China owns over 25% of U.S. Treasury Bonds and is the largest creditor in the world.

[ Rediff Business online, November 2010 ]

China is the U.S.A.’s largest creditor, holding more than $900 billion worth of U.S. Treasury bonds (as of Oct. 2010). The #2 and #3 creditors are Japan and the U.K.

[ Reuters “Factbox: China leads list of biggest U.S. creditors” Jan. 10, 2011 ]

China facts: IPO & STOCK MARKET

China became the world’s biggest initial public offering market in 2010.

[Dealogic 2011, PricewaterhouseCoopers July 2010 ]

China’s emerging market stocks are predicted to quintuple in the next two decades–reaching a market value of around $80 trillion by 2030.

[ Goldman Sachs strategist, Timothy Moe, September 2010 ]

The Shanghai Stock Exchange is the fifth largest stock market in the world as of December 2010 (market capitalization of US$2.7 trillion).

[ Wikipedia “List of stock exchanges” ]

Eight of the ten largest stocks on the Shanghai Stock Exchange are state-controlled enterprises.

[ Wikipedia “Shanghai Stock Exchange”]

China facts: TRADE, FDI, & EXPORTS

China was the second-largest recipient of Foreign Direct Investment (FDI) in 2009, attracting US$95 billion, (behind only the U.S., which drew in $130 billion).

[ United Nations report, July 2010 ]

China attracted $105.7 billion in foreign direct investment in 2010—the first time FDI in China crossed the $100 billion mark.

[ Reuters “China FDI rises strongly in January, outlook bright” Feb. 17, 2011; Economist “Foreign Direct Investment” Jan. 20, 2011 ]

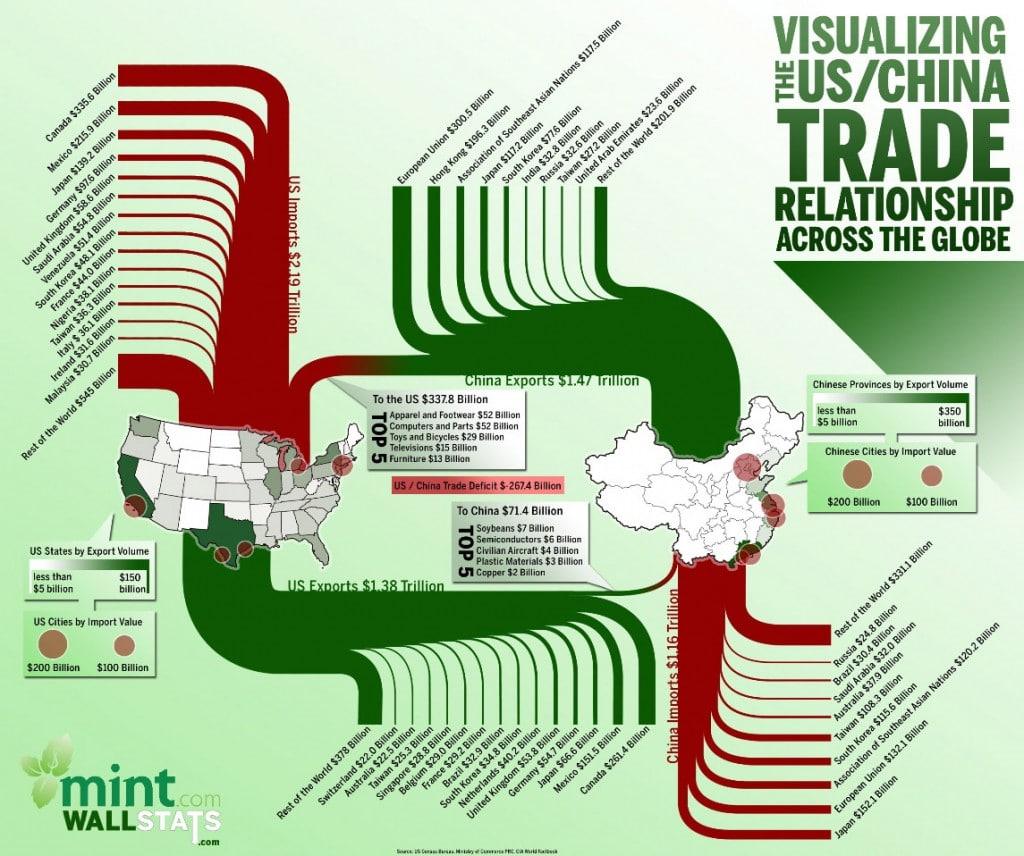

China is the world’s number one exporter after taking the top spot from Germany in 2009. China’s total 2009 were US$1.2 trillion, compared to Germany’s US $1.17 trillion (816 billion euros).

[ AP, New York Times January 10, 2010, China’s customs office, the Federation of German Wholesale and Foreign Trade ]

About 20% of China’s exports go to the United States.

[ The World Bank ]

The U.S. is China’s largest trading partner.

[ “China: Asia in Focus”, R. LaFleur 2010]

In 2010, U.S. exports of goods to China jumped 32%, to US$92 billion.

[ Time Mag. “Your Next Job: Made in India or China” March 17, 2011 ]

7 of China’s top 10 trading partners are in Asia, including Japan, South Korea, Taiwan, Singapore (and Hong Kong).

[ “China: Asia in Focus”, R. LaFleur 2010]

Six of the world’s largest container ports are in China.

[ The Economist online, “Trading Places” August 24, 2010 ]

China is North Korea’s largest trading partner.

[Council on Foreign Relations, “The China-North Korea Relationship “ Oct. 2010 ]

INTELLECTUAL PROPERTY & COUNTERFEIT GOODS

China has some of the highest piracy rates in the world—with a piracy rate of 96% in PC software, 93% in motion pictures, and 85% in records and music.

[“China Fever” F. Fang 2007, International Intellectual Property Alliance (IIPA) report, Feb. 18. 2010 ]

The U.S. Trade Representative’s office estimated in 2005 that 85% to 93% of all sales of copyrighted products in China were pirated.

[“China Fever” F. Fang 2007 ]

The International Intellectual Property Alliance has estimated U.S. trade losses in China due to piracy at $3.5 billion in 2009—combined losses from music, movie, book, and software companies.

[ IIPA; Reuters “China vows tougher punishments for copyright piracy” Jan. 10, 2011 ]

An estimated 79 percent of China’s computers run on pirated software, according to the Business Software Alliance.

[ PC Mag “Twelve Software CEOs to Talk China Piracy with White House. June 9, 2010 ]

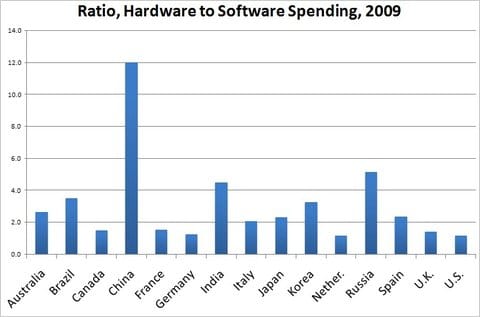

China is world’s second-largest market for computer hardware sales…but is only the eighth-largest for software sales.

[The New York Times “The Real Problem With China” Jan. 11 2011 ]

9 out of 10 DVDs sold in China are illegal copies according to the Motion Picture Association of America—costing Hollywood US$2.3billion a year in lost revenue.

[“China Fever” F. Fang 2007 ]

79% of counterfeit and pirated goods seized by U.S. Customs are of Chinese origin, representing $204.7 million of the total seizure value in 2009.

[ U.S. Customs & Border Protection ]

(Click here to see “In China, Even Crooks Get Ripped Off” in China facts: WEIRD & ODDBALL )

In the late 1800s, Europeans widely viewed America as the source of inferior goods and pirated versions of best selling books, according to U.S. historian Stephen Mihm. For instance, Charles Dickens complained bitterly about how many unauthorized copies of his books were sold in the U.S.

[ “China in the 21st Century” J. Wasserstrom, 2010 ]

In the 19th century, the U.S. was—as China is now—“a predominantly rural country undergoing a massive shift toward an urban, industrial economy. By the 1850s, the U.S. was en route to becoming the workshop of the world, rapidly churning out cheap yet high-quality textiles, clocks, guns and other goods. The British dubbed this miracle the ‘American system of manufactures,’ and it became the envy of the world…British commentators once said (that) New England factories used reverse engineering to mimic the latest Lancashire technological breakthroughs.”

[ Time Mag. “How China Is like 19th Century America” Nov. 7, 2010 ]

[ For more funny Chinese counterfeit brands ]

CHINA’S ENTREPRENEURS

98% of China’s banking assets are state-owned, as are most of China’s financial institutions.

[ Rediff Business online, November 2010 ]

“China’s state-controlled entities are not particularly profitable.” The average return on equity for companies wholly or partly owned by the state is barely 4%. In comparison, the returns of unlisted private firms are no less than ten percentage points higher. “It is often said in China that a new economic era has recently begun, described as guo jin min tui: state advances, private retreats.”

[ The Economist “Let a million flowers bloom” March 10, 2011 ]

The number of registered private businesses in China grew by more than 30% a year between 2000 and 2009. But “these figures exclude unregistered businesses…No one knows quite how much private companies contribute to China’s fast-growing economy…However, enterprises that are not majority-owned by the state account for two-thirds of industrial output.”

[ The Economist “Let a million flowers bloom” March 10, 2011 ]

China’s private firms account for about 75-80% of profit in Chinese industry and 90% in non-financial services.

[ The Economist “Let a million flowers bloom” March 10, 2011 ]

NEXT: China Facts: MANUFACTURING & WORKFORCE >>

Return to Facts about China home page